RE/MAX National Housing Report for March 2019

March Sales Signal Slowest Start to Spring Homebuying Since 2014

DENVER – Kicking off the spring homebuying season, March sales climbed almost 29% over February, according to the RE/MAX National Housing Report. But this remains the slowest start in five years, with March sales 8.6% lower than March 2018.

March was the eighth consecutive month of year-over-year sales declines and the sixth straight month of year-over-year inventory growth, with a 5.3% gain. Housing activity in the report’s 54 markets nationwide also saw the Median Sales price grow by 3.4% year-over-year – notably smaller than the year-over-year increases in February (5.5%) and January (4.6%). However, the median sales price has risen by more than 3% year-over-year in 17 of the last 18 months.

From 2015 to 2018, the housing market’s spring sprang to life with an increase in sales from February to March averaging 37.0%. March 2019’s month-over-month increase of 28.8% was the smallest since 24.6% in 2014.

Days on Market increased to 59 from 57 last March, while Months Supply of Inventory declined year-over-year to 2.7 from 3.0.

“It was encouraging to see month-over-month sales improve during March,” said RE/MAX CEO Adam Contos. “Although the seasonal bounce that typically ends the first quarter wasn’t as strong as in the past few years, conditions are in place for a healthy spring selling season. Falling interest rates, rising inventory and moderating price increases against the backdrop of a healthy overall economy are cause for optimism for buyers and sellers alike.”

Closed Transactions

Of the 54 metro areas surveyed in March 2019, the overall average number of home sales is up

28.8% compared to February 2019, and down 8.6% compared to March 2018. Leading the month-over-month sales percentage increase were Burlington, VT, at +48.3%, Wichita, KS, at +46.8%, and San Francisco, CA, at +44.3%.

Median Sales Price – Median of 54 metro median prices

In March 2019, the median of all 54 metro Median Sales Prices was $246,000, up 2.5% from February 2019, and up 3.4% from March 2018. Two metro areas saw a year-over-year decrease in Median Sales Price: San Francisco, CA, at -3.8% and Hartford, CT, at -1.4%. Three metro areas increased year-over-year by double-digit percentages – Manchester, NH, at +12.2%, Omaha, NE, at +11.8%, and Wichita, KS, at +10.7%.

Days on Market – Average of 54 metro areas

The average Days on Market for homes sold in March 2019 was 59, down three days from the average in February 2019, and up two days from the March 2018 average. The metro areas with the lowest Days on Market were Omaha, NE, and San Francisco, CA, both at 31, and Denver, CO, at 35. The highest Days on Market averages were in Augusta, ME, at 122, and Burlington, VT, and Hartford, CT, both at 97. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 54 metro areas

The number of homes for sale in March 2019 was up 0.3% from February 2019 and up 5.3% from March 2018. Based on the rate of home sales in March 2019, the Months Supply of Inventory decreased to 2.7 from 3.7 in February 2019, and from 3.0 in March 2018. A six-months supply indicates a market balanced equally between buyers and sellers. In March 2019, of the 54 metro areas surveyed, only Miami, FL, at 6.5 reported a supply at or over six months, which is typically considered a buyer’s market. The markets with the lowest Months Supply of Inventory were Denver, CO, at 1.2, and four metros at 1.3 – San Francisco, CA, Seattle, WA, Boise, ID, and Manchester, NH.

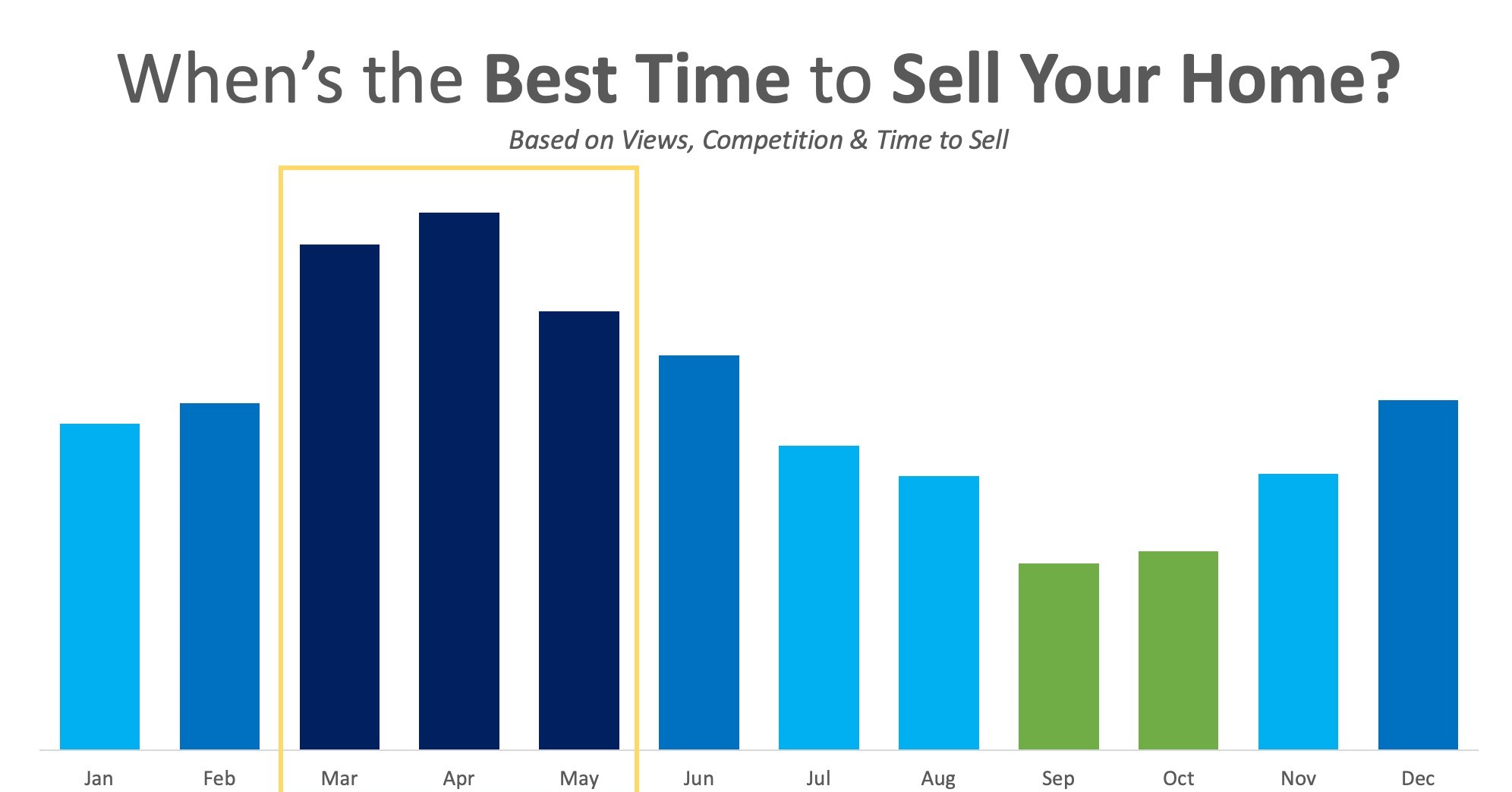

Feel free to contact me and I can help break down exactly what these numbers mean for our local market and for your neighborhood. And lastly, If you or anyone you know is thinking of buying or selling a home - please call or email me. I'm here to help!

Peter Veres

Associate Broker,CRS,ABR,CLHMS,SRES

Elite Asset Management Team - RE/MAX Elite

www.PeteVeres.com

Cell: 505-362-2005