May 2018 RE/MAX National Housing Report

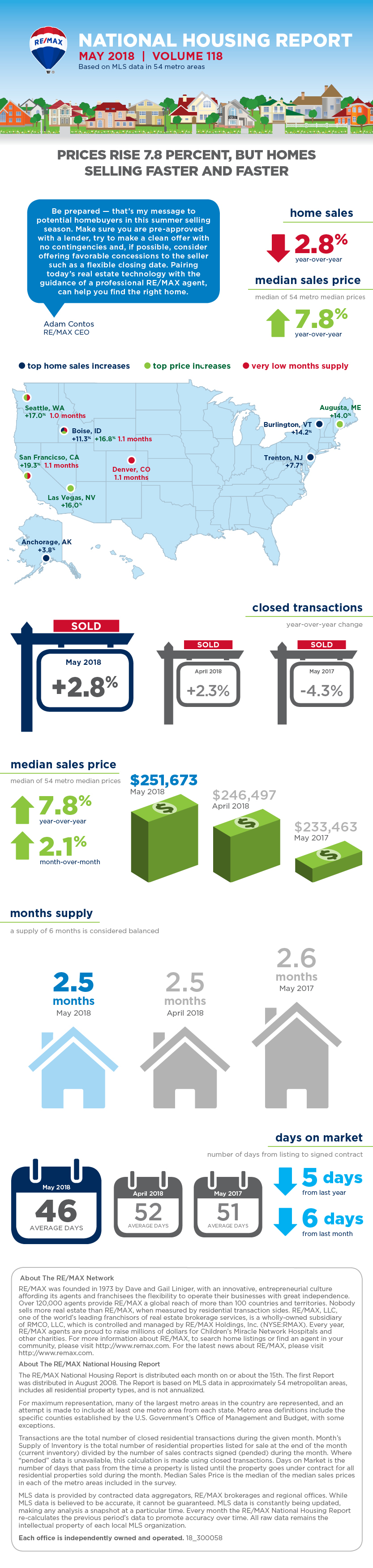

Prices Rise 7.8 Percent, But Homes Selling Faster and Faster

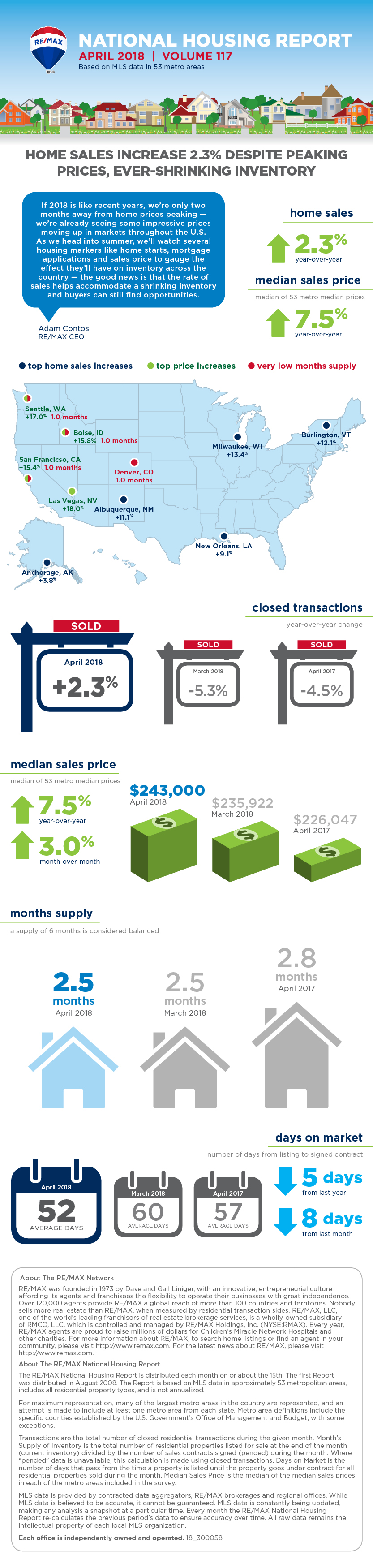

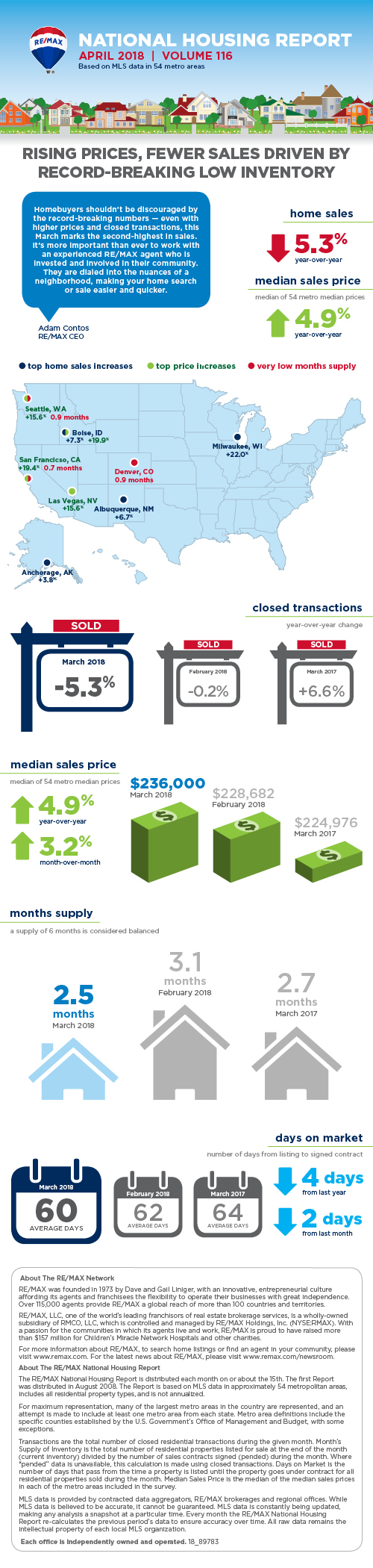

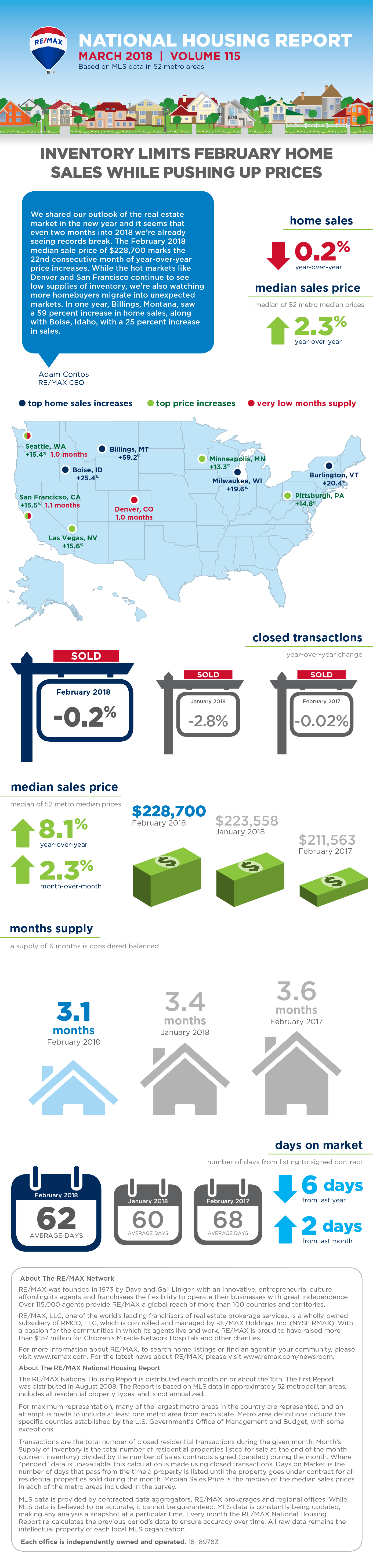

DENVER – In May, homes sold faster than at virtually any other time in the past decade, according to the latest RE/MAX National Housing Report. Low inventory and high demand in May cut Days on Market to 46, the second-lowest monthly number in the nearly 10-year history of the report.

May home sales topped April sales by 14.5%, and were down by 2.8% from May 2017. The median sales price of $251,673 was up 7.8%.

By comparison, homes averaged five more days on the market (51) in May 2017, 12 more days (58) in May 2016 and 18 more days (64) in 2015.

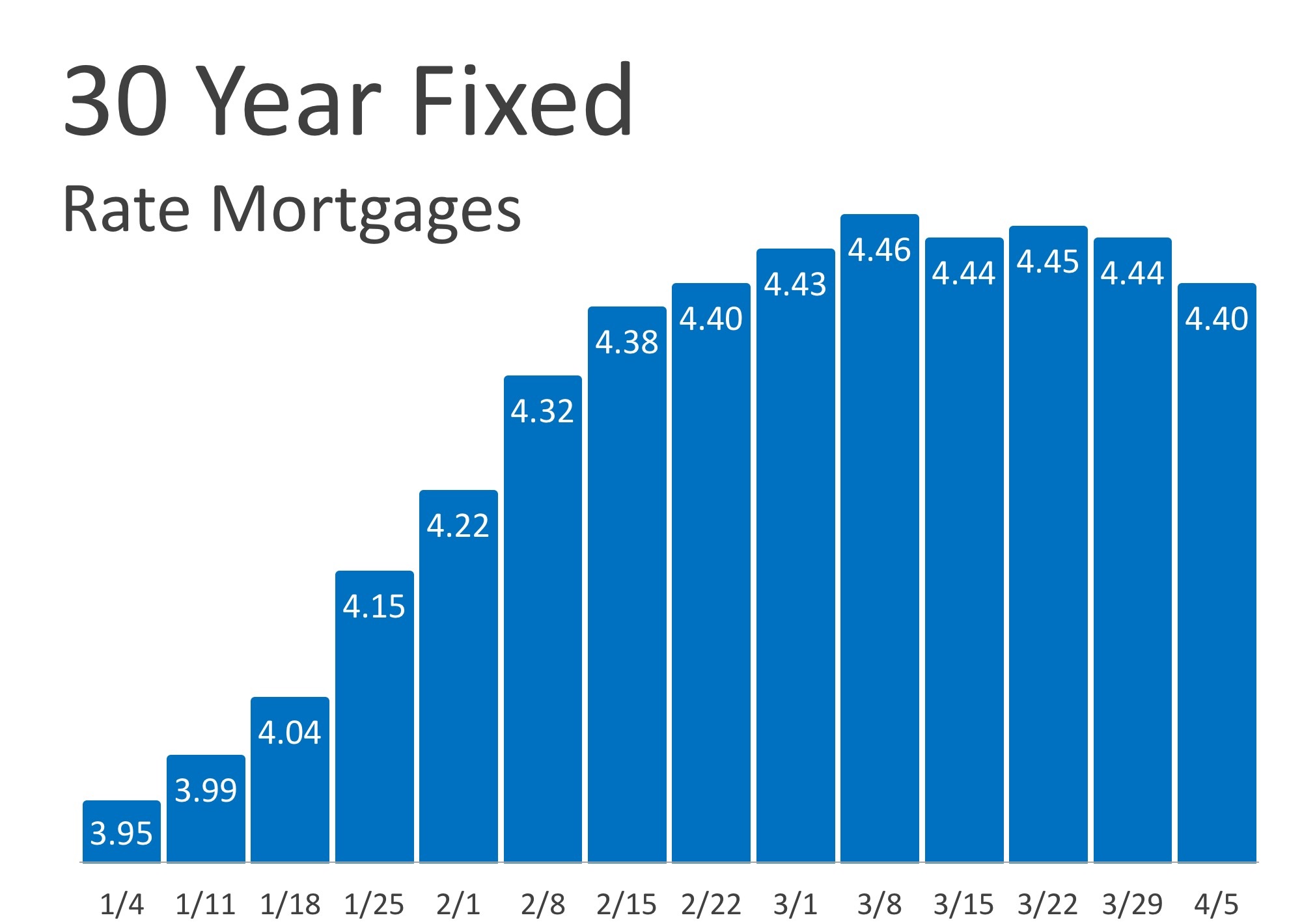

“Even with low inventory and the Federal Reserve raising interest rates, homes are going from ‘for sale’ to sold 28 percent faster than three years ago,” said RE/MAX CEO Adam Contos.

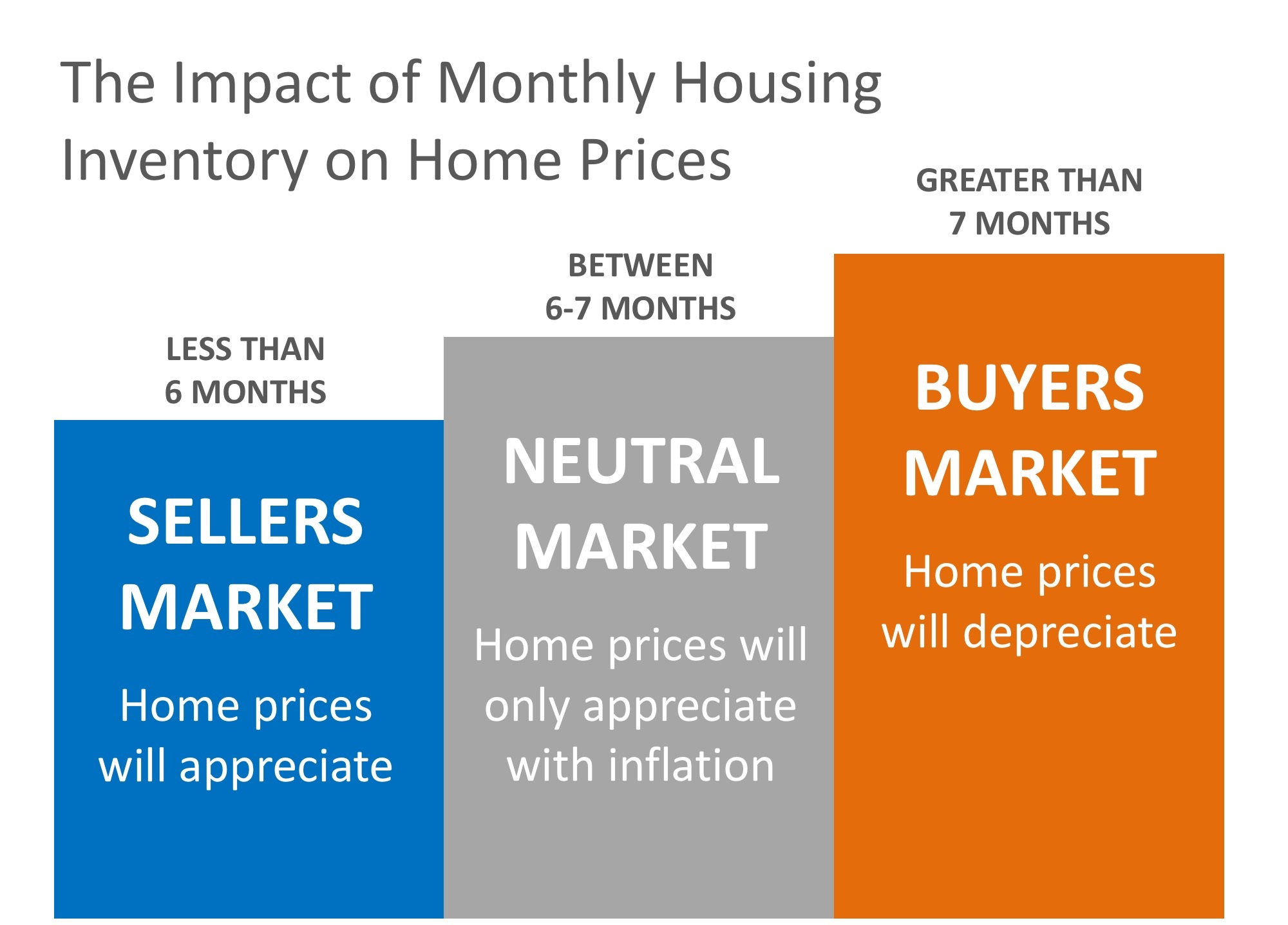

With 11 metro areas increasing the median sales price year-over-year by double digits, May is still a seller’s market, and homebuyers should expect to compete with other buyers when they are ready to make an offer on a home.

“Be prepared — that’s my message to potential homebuyers in this summer selling season,” added Contos. “Make sure you are pre-approved with a lender, try to make a clean offer with no contingencies and, if possible, consider offering favorable concessions to the seller such as a flexible closing date. Pairing today’s real estate technology with the guidance of a professional RE/MAX agent, can help you find the right home.”

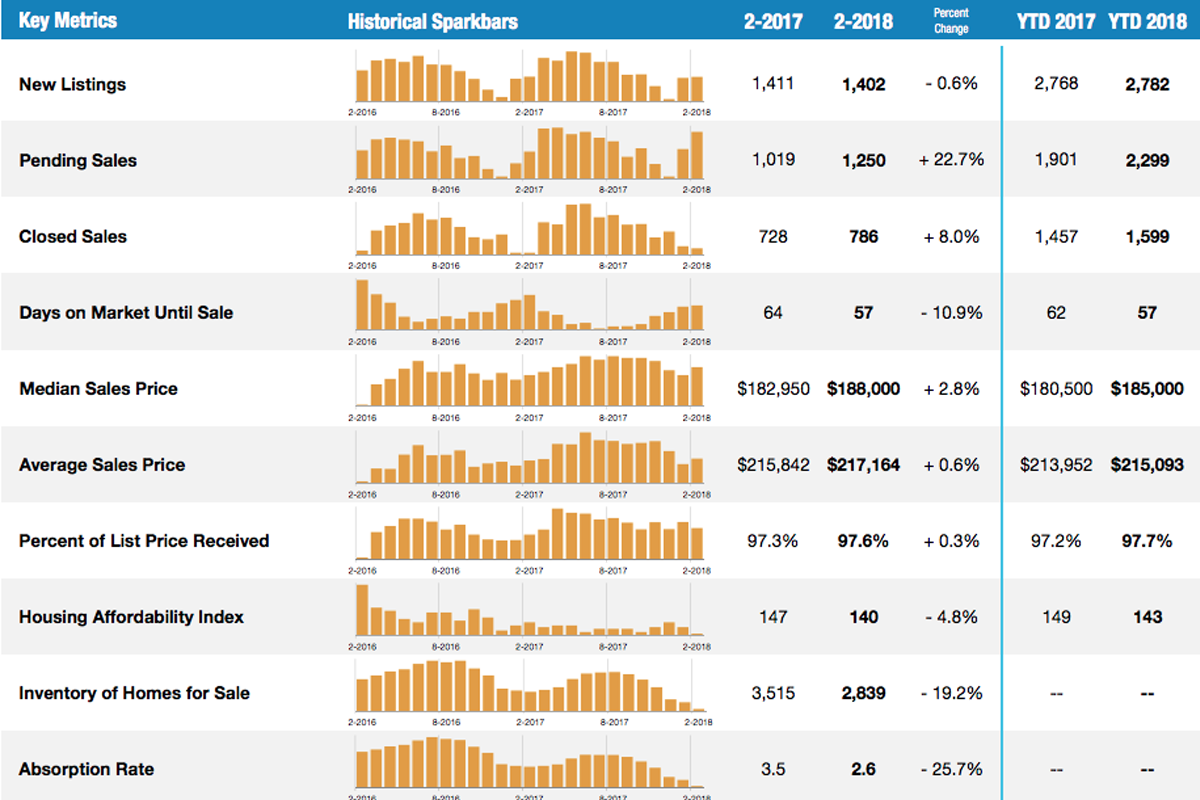

Closed Transactions

Of the 54 metro areas surveyed in May 2018, the overall average number of home sales increased 14.5% compared to April 2018 and decreased 2.8% compared to May 2017. Sixteen of the 54 metro areas experienced an increase in sales year-over-year, including, Burlington, VT, +14.2%, Boise, ID, +11.3%, Trenton, NJ, +7.7% and Anchorage, AK at +3.8%.

Median Sales Price – Median of 54 metro median prices

In May 2018, the median of all 54 metro Median Sales Prices was $251,673, up 2.1% from April 2018 and up 7.8% from May 2017. Three metro areas saw a year-over-year decrease in Median Sales Price: Trenton, NJ, -2.4%, Anchorage, AK, -1.2% and Hartford, CT, -0.7%. Eleven metro areas increased year-over-year by double-digit percentages, with the largest increases seen in San Francisco, CA, +19.3%, Boise, ID, +16.8%, Las Vegas, NV, +16% and Augusta, ME, +14%.

Days on Market – Average of 54 metro areas

The average Days on Market for homes sold in May 2018 was 46, down six days from the average in April 2018, and down five days from the May 2017 average. The metro areas with the lowest Days on Market were San Francisco, CA and Seattle, WA, at 19, Denver, CO, at 21 and Salt Lake City, UT, at 25. The highest Days on Market averages were in Augusta, ME, at 115, Hartford, CT, at 83, and New York, NY and Miami, FL at 82. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

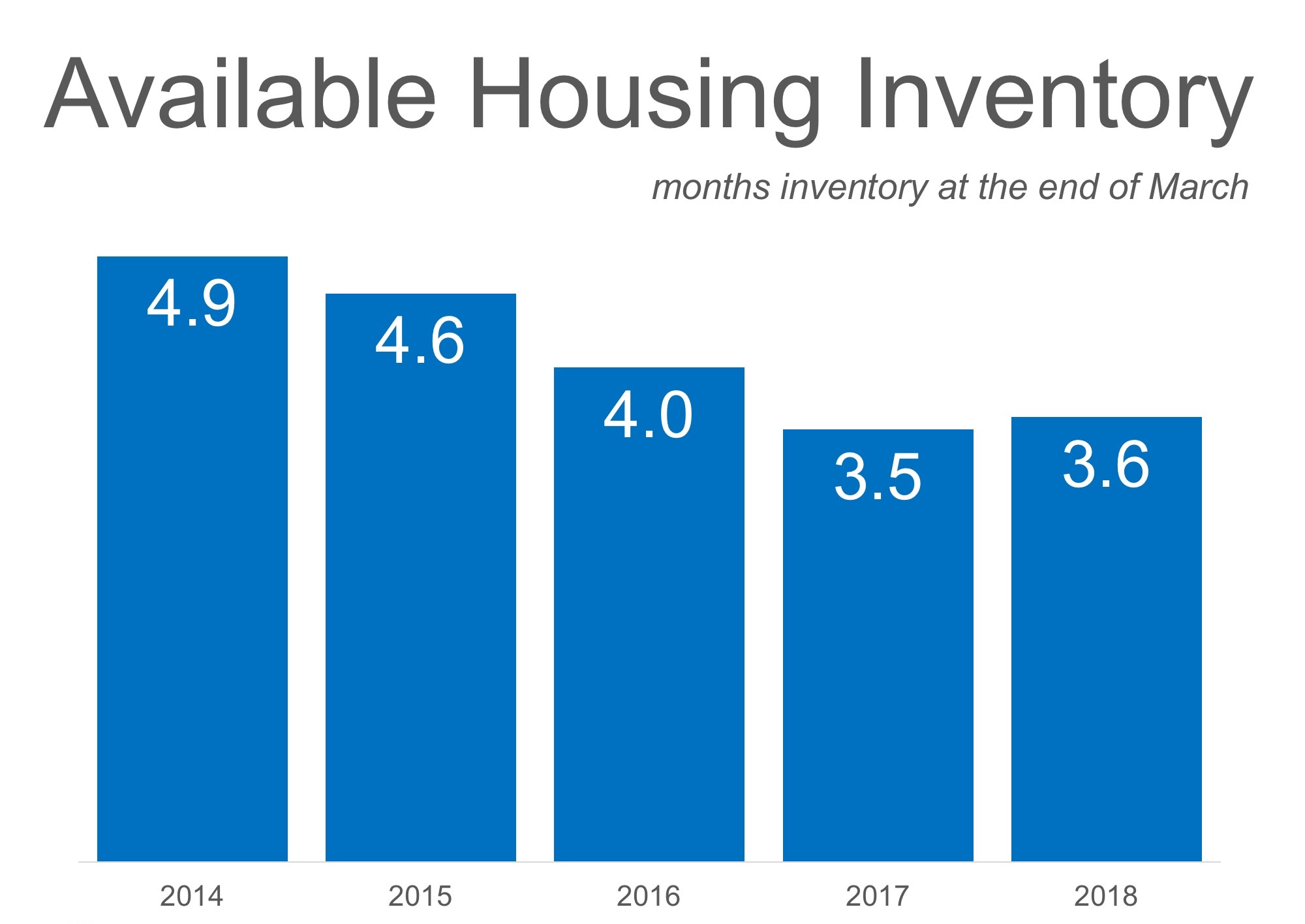

Months Supply of Inventory – Average of 54 metro areas

The number of homes for sale in May 2018 was up 4% from April 2018, and down 9.5% from May 2017. Based on the rate of home sales in May, the Months Supply of Inventory remained unchanged from April 2018 at 2.5, and slightly decreased compared to 2.6 in May 2017. A 6.0-months supply indicates a market balanced equally between buyers and sellers. In May 2018, all 54 metro areas surveyed reported a months supply at or less than 6.0, which is typically considered a seller’s market. The markets with the lowest Months Supply of Inventory are in the west with San Francisco, CA, at 1.0 and Boise, ID, Denver, CO, and Seattle, WA, tied at 1.1.

Feel free to contact me and I can help break down exactly what these numbers mean for our local market and for your neighborhood. And lastly, If you or anyone you know is thinking of buying or selling a home - please call or email me. I'm here to help!

Peter Veres

Associate Broker,CRS,ABR,CLHMS,SRES

Elite Asset Management Team - RE/MAX Elite

www.PeteVeres.com

Cell: 505-362-2005

Office: 505-798-1000